Study Shows Maine Ranks Close to the Nation

Written by New Ventures Maine | Published on August 25, 2016

The Financial Industry Regulatory Authority (FINRA) recently released the National Financial Capability Study (NFCS) based on data collected in 2015. This study provides data that focuses on 4 components that lead towards being financially stable, including Making Ends Meet, Planning Ahead, Managing Financial Products, Financial Knowledge and Decision Making. Compared to the nation as a whole Maine has numbers that are equal or better in several of these component categories.

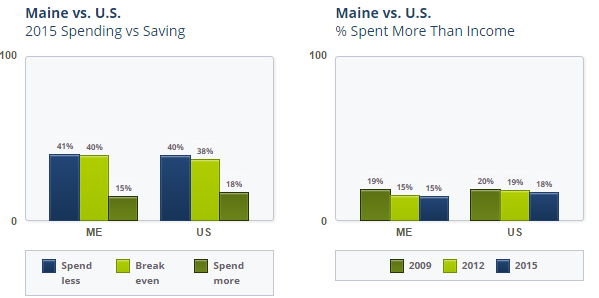

The Making Ends Meet category includes spending based on household income and having overdue medical bills. The data show that Maine people are spending less than their income or are breaking even. The percentage of citizens who do spend over their income is 15%; compared to the national average of of 18%.

Medical bills are a concern for many due to the rising cost of medical care. In Maine 23% of people surveyed had overdue medical bills. This is a little higher than the national average of 21%.

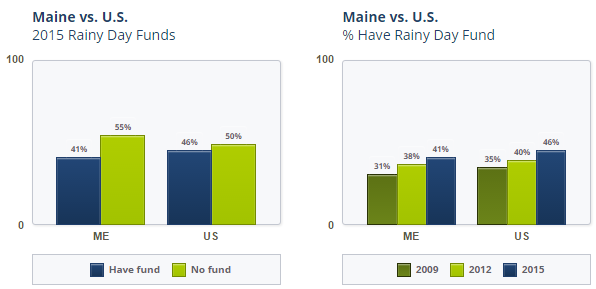

The Planning Ahead category reviews whether or not people have a Rainy Day Fund. While the data shows that less Maine people have money saved for emergency expenses compared to the rest of the U.S., the study also suggests that more Maine people are setting up these funds than in the past.Maine people with Rainy Day Savings funds has risen from 31% in 2009 to 41% in 2015. In Maine, people who meet the eligibility requirements can open a Rainy Day Savings Account through New Ventures Maine, a partner of CA$H Maine.

The category of Managing Financial Products includes the use of non-banking borrowing, minimum payments on credit cards and home equity. There has been a national trend to use non-banking borrowing such payday loans, pawn shops, and rent-to-own stores. Nationally these services are used by 26% of people. In Maine the percentage is lower at 18%, showing that more traditional banking options for borrowing are being used.

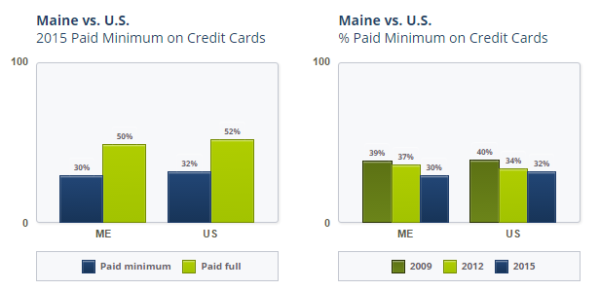

Maine does fall behind slightly in making the minimum payments on credit cards. 30% of Maine people who were surveyed are paying the minimum payments on their credit cards. 50% of those surveyed are paying the full balance each month. On a national level 32% of people surveyed pay the minimum payment, compared to 52% who pay the full balance each month.

Maine does come in higher when it comes to home equity with 91% of homeowners having equity in their homes, compared to 84% nationally.

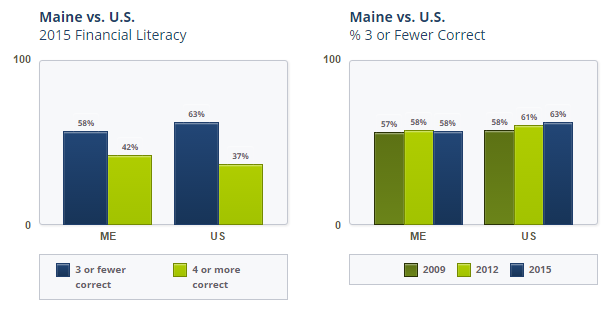

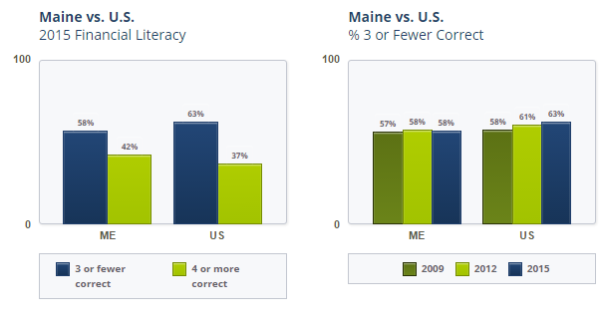

The final category, Financial Knowledge and Decision Making showcases financial literacy knowledge and comparison shopping for credit cards. Based on the how many questions the survey participants answered correctly, we can see that Maine is more well versed in financial knowledge than the nation as a whole, but there is still room to grow. 42% of the Maine people surveyed answered 4 or more questions correctly, and 58% answered 4 or more questions correctly. Nationally 37% of people surveyed answered 4 or more questions correctly.

37% of Maine people used comparison shopping for credit cards, compared to 35% of people nationally.

While some of Maine’s results are higher than the national level, most are very close to the national average. This shows us that we already have a good foundation in many of the areas compared to the nation as a whole. We can still do better, therefore there is still work to be done. Encouraging the people of Maine to continue learning about their finances and sharing year round resources is part of what we do at CA$H Maine.

Arabic

Arabic French

French Portuguese

Portuguese Somali

Somali Spanish

Spanish Swahili

Swahili