Five Benefits of VITA and VITA Volunteers

Written by New Ventures Maine | Published on April 24, 2020

Adapted from an article By Jordan Blakemore, 2020 Get It Back Campaign Intern

Each year, thousands of IRS certified volunteers offer their time and expertise at Volunteer Income Tax Assistance (VITA) sites across the country to help millions of Americans file taxes free of charge. VITA is an IRS-sponsored program staffed by volunteers who are committed to helping millions of low- and moderate-income people file their taxes by providing accurate, free, and trustworthy tax preparation assistance.

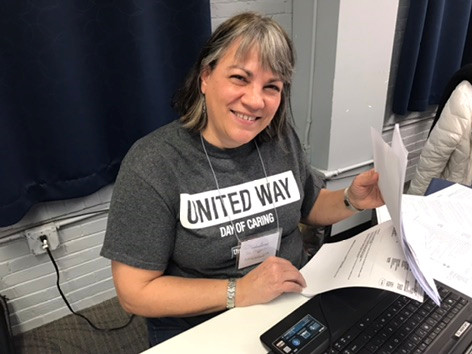

This week as we celebrate Volunteer Appreciation Week we celebrate our VITA volunteers— from site coordinators, tax preparers, intake specialists, greeters, and opportunity guides. We also acknowledge the challenges some taxpayers are experiencing due to VITA site closures from COVID-19. Check here for updates around closures and other options for filing until tax sites are able to reopen.

Volunteers are essential to free tax preparation. Five reasons why VITA volunteers are amazing are that they:

1. Help clients claim valuable tax credits they’ve earned

The Earned Income Tax Credit and Child Tax Credit lift millions of hard working Americans out of poverty each year.

2. Save taxpayers money

Refund anticipation checks and fees for a paid preparer can eat up much of a filer’s tax refund. VITA volunteers are committed to providing quality tax services—free of charge!

The average tax return costs a taxpayer nearly $300. This money can instead buy groceries or help with the rent.

3. Prioritize accurate returns

Unlike paid preparers, who aren’t required to have a license, VITA volunteers are trained extensively and must certify through the IRS annually. In addition, all tax returns are reviewed by at least one other preparer before they’re submitted. This helps maintain accuracy rates higher than 90 percent.

4. Care about taxpayers

Volunteers are patient and willingly explain the tax filing process to help taxpayers understand their tax returns and tax filing responsibilities.

5. Are dedicated to serving the needs of taxpayers

At CA$H Maine VITA sites opportunity guides provide assistance to tax filers about savings, classes, and other resources to help them meet their financial needs and reach their financial goals. As many VITA sites are forced to close due to safety concerns about the COVID-19 outbreak, volunteers are finding creative ways for people to file taxes such as drop off sites or assisting them remotely.

Thank you to the thousands of VITA volunteers across the country and in particular the hundreds of CA$H Maine volunteers. Your hard work does not go unnoticed! VITA volunteers help those who need it most keep their hard-earned money.